Андрей

Администратор

- Регистрация

- 28.01.14

- Сообщения

- 353

- Реакции

- 162

Андрей не предоставил никакой дополнительной информации.

Индикаторы от OptionClick.

Индикатор №1 OCLICK_ARROWS

Индикатор №2 OCLICK_CHARTS_ARROWS

Индикатор №3 OCLICK_MOV_2

Индикатор №4 OCLICK

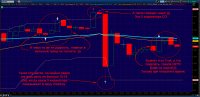

Результат тестов OptionClick

Индикатор №1 OCLICK_ARROWS

Код:

# OPTIONCLICK.RU

# info@optionclick.ru

# 27/02/2014

declare upper;

input price = hl2;

input length = 10;

def num = fold count = 1 to length with num_temp = 0 do

num_temp + (1 + count) * price[count];

def denom = fold count2 = 1 to length with denom_temp = 0 do

denom_temp + price[count2];

def Ehler_CG = if(denom==0,0,-num/denom);

def CG = Ehler_CG;

def CG1 = Ehler_CG[1];

#

plot UP1 = if CG crosses above CG1 then low else Double.NaN;

UP1.SetPaintingStrategy(PaintingStrategy.aRROW_UP);

UP1.SetDefaultColor(Color.WHITE);

UP1.SetLineWeight(3);

UP1.HideBubble();

#

plot down1 = if CG crosses below CG1 then high else Double.NaN;

down1.SetPaintingStrategy(PaintingStrategy.aRROW_DOWN);

down1.SetDefaultColor(Color.WHITE);

down1.SetLineWeight(3);

down1.HideBubble();

Код:

# http://OPTIONCLICK.RU

# info@optionclick.ru

# 27/02/2014

input length = 5;

input filterOutSignalsBelow = 6;

def VarP = round(length / 5);

def VarA = Highest(high, VarP) - Lowest(low, VarP);

def VarR1 = if VarA == 0 and VarP == 1 then AbsValue(close - close[VarP]) else VarA;

def VarB = Highest(high, VarP)[VarP + 1] - Lowest(low, VarP)[VarP];

def VarR2 = If VarB == 0 and VarP == 1 then AbsValue(close[VarP] - close[VarP * 2]) else VarB;

def VarC = Highest(high, VarP)[VarP * 2] - Lowest(low, VarP)[VarP * 2];

def VarR3 = If VarC == 0 and VarP == 1 then AbsValue(close[VarP * 2] - close[VarP * 3]) else VarC;

def VarD = Highest(high, VarP)[VarP * 3] - Lowest(low, VarP)[VarP * 3];

def VarR4 =

If VarD == 0 and VarP == 1 then AbsValue(close[VarP * 3] - close[VarP * 4]) else VarD;

def VarE = Highest(high, VarP)[VarP * 4] - Lowest(low, VarP)[VarP * 4];

def VarR5 = If VarE == 0 and VarP == 1 then AbsValue(close[VarP * 4] - close[VarP * 5]) else VarE;

def LRange = ((VarR1 + VarR2 + VarR3 + VarR4 + VarR5) / 5) * 0.2;

def Var0 = if AbsValue(close - close[1]) > (high - low) then AbsValue(close - close[1]) else (high - low);

def LRange2 = if high == low then Average(AbsValue(close - close[1]), 5) * 0.2 else Average(Var0, 5) * 0.2;

def range = high + low;

def delta = high - low;

def median = range / 2;

def floatingAxis = Average(median, length);

def dynamicVolatilityUnit = if length <= 7 then LRange2 else LRange;

def relativeHigh = (high - floatingAxis) / dynamicVolatilityUnit;

def relativeLow = (low - floatingAxis) / dynamicVolatilityUnit;

def relativeOpen = (open - floatingAxis) / dynamicVolatilityUnit;

def relativeClose = (close - floatingAxis) / dynamicVolatilityUnit;

def h = relativeHigh;

def l = relativeLow;

def sellDivergence = if high > high[1] and relativeHigh < relativeHigh[1] and relativeHigh[1] > filterOutSignalsBelow then 1 else 0;

def buyDivergence = if low < low[1] and relativeLow > relativeLow[1] and relativeLow[1] < -filterOutSignalsBelow then 1 else 0;

def hiddenDivergenceUp = if low > low[1] and relativeLow < relativeLow[1] then 1 else 0;

def hiddenDivergenceDown = if high < high[1] and relativeHigh > relativeHigh[1] then 1 else 0;

plot upArrow = if buyDivergence then low else double.nan;

upArrow.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_UP);

upArrow.SetDefaultColor(color.white);

upArrow.SetLineWeight(3);

plot downArrow = if sellDivergence then high else double.nan;

downArrow.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_DOWN);

downArrow.SetDefaultColor(color.white);

downArrow.SetLineWeight(3);

plot continuationDown = if hiddenDivergenceDown then high else double.nan;

continuationDown.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_DOWN);

continuationDown.SetDefaultColor(color.white);

continuationDown.SetLineWeight(1);

continuationDown.hide();

plot continuationUp = if hiddenDivergenceUp then low else double.nan;

continuationUp.SetPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_UP);

continuationUp.SetDefaultColor(color.white);

continuationUp.SetLineWeight(1);

continuationUp.hide();

Код:

#OPTIONCLICK.RU

#info@optionclick.ru

#27/02/2014

input EMAPeriod = 10;

input SMAPeriod = 20;

input price = close;

def na = double.nan;

plot fastema = ExpAverage(price, EMAPeriod);

plot slowema = Average(price, SMAPeriod);

def crossover = if fastema > slowema AND fastema[1] <= slowema[1] then 1 else 0;

def crossunder = if fastema < slowema AND fastema[1] >= slowema[1] then 1 else 0;

#Plot arrows

Plot up = if crossover then low - tickSize() else na;

Plot down = if crossunder then high + tickSize() else na;

up.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

down.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

up.SetLineWeight(3);

up.AssignValueColor(color.WHITE);

down.SetLineWeight(3);

down.AssignValueColor(color.WHITE);

#Trigger alerts

alert(crossover[1], "Crossover", Alert.Bar, Sound.Ding);

alert(crossunder[1], "Crossunder", Alert.Bar, Sound.Ding);

Код:

# OPTIONCLICK.RU SIGNALS REALTIME

# 24/02/2014

# info@optionclick.ru

Input AlertsOn = no;

Input ShowTodayOnly = yes;

Def Today = if !ShowTodayOnly then 1 else if getday() == getLastDay() then 1 else 0;

def space = average(high-low)/5;

# buy signal

plot ppsBuy = If !Today then Double.NaN else pps().buySignal-space;

ppsBuy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

ppsbuy.SetLineWeight(5);

ppsBuy.AssignValueColor(color.WHITE);

alert(AlertsOn && ppsBuy, “PPS Buy Signal”,alert.BAR, sound.Ring);

# sell signal

plot ppsSell = If !Today then Double.NaN else pps().sellSignal+space;

ppsSell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

ppsSell.SetLineWeight(5);

ppsSell.AssignValueColor(color.WHITE);

alert(AlertsOn && ppsSell, “PPS Sell Signal”,alert.BAR, sound.Bell);Результат тестов OptionClick

Последнее редактирование модератором: